Solar Incentives in New York

In New York, the NY-Sun program works with solar contractors and developers to offset the cost of purchasing and installing a solar panel system for your business. The incentives provided vary throughout the State.

NY-Sun also partners with private-sector financiers to offer New York business owners loans to fund solar systems.

New York also offers property tax abatement for photovoltaic (PV) and energy storage equipment. This abatement allows building owners to deduct. from their total real property taxes a portion of the costs associated with PV system installation. The abatement is 7.5%, or a maximum of $62,500 per year.

Act Now!

New York still offers many significant solar incentives for business owners. These incentives can be paired with the USDA's 50% rebate to drastically reduce the total out of pocket cost of a solar system, and allow business owner's to fully recoup the value of their systems in as little as one year. Fill out our interest form to get started!

The REAP Grant is available in:

|

|

|

|

|

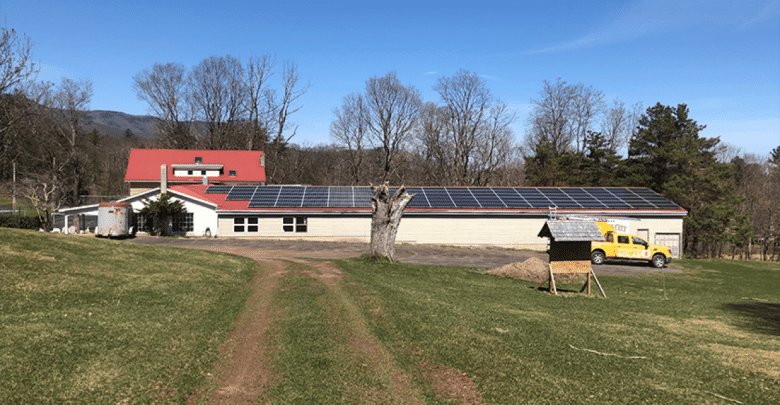

Ready to add solar to your business?

Let us connect you with the right installation team.