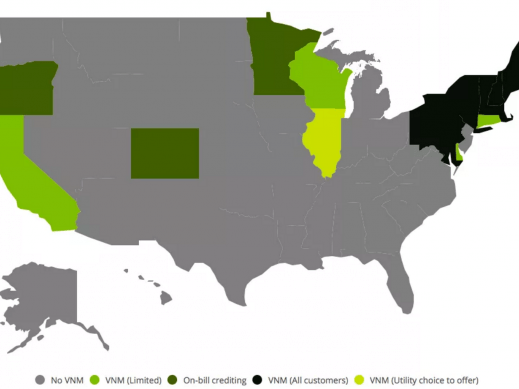

Hawaii continues to lead the US in the evolution and implementation of renewable energy policy. This past Spring we watched as Hawaii introduced the most ambitious renewable goal in the country: 100% renewable electricity generation by 2045. Although solar penetration on the big island leads the country (roughly 12% of residences tying solar to the grid with solar supplying up to 50% of system peak load), on the whole, renewables constitute only 20% of generation today. In the face of dramatic increases in solar capacity to satisfy the new renewable portfolio standard (RPS), the Hawaii PUC has announced an end to the current net metering (NEM) scheme. Similarly, California recently increased its RPS to 50% by 2030 and while facing a mandated shift in NEM policy in 2017.

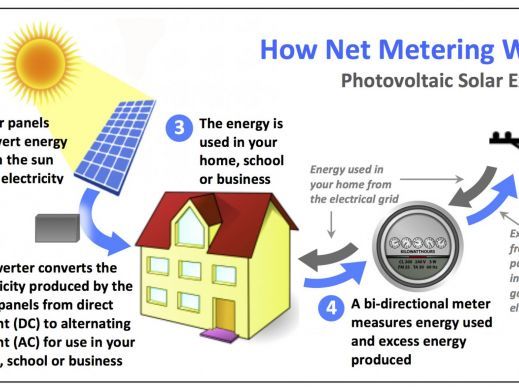

Once again, we can look to Hawaii for clues as to what we can expect for the future of net metering in California and beyond as other states seek to roll out modified residential solar compensation schemes. Hawaii capped distributed energy net metering on October 12. This ruling will not impact existing net-metered systems, however systems installed after October 12 will no longer have access to net metering at retail rates. In place of full retail rate compensation, the PUC has outlined two alternative programs to continue support of solar and other distributed energy resources; customer grid supply (CGS) and customer self supply (CSS).

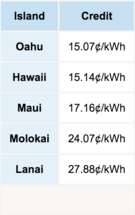

Under the CGS option, customers will be compensated in a similar manner to existing NEM however the rate of compensation will fall from the retail rate of 30 ¢/kWH to 15-27 ¢/kWh depending upon location. Additionally, CGS customers will face a minimum utility bill of $25. The CSS option dictates PV power is to be used on site with no compensation for export to the grid. This option is aimed at promoting the adoption of distributed energy storage and smoothing out on site supply and demand peaks. CSS customers that remain grid-tied will face a $25 minimum bill. Commercial customers across both programs will face a $50 minimum bill.

The Hawaii PUC ruling and expected changes in California have evoked mixed reactions from both utilities and solar proponents. On the one hand, many argue the current NEM scheme has achieved is underlying goal of increasing the adoption of solar PV. Since the policy was introduced in HI in 1996 the cost of solar has plummeted, leading some to contend the retail rate scheme overcompensates solar systems installed today, while burdening fixed grid costs on non-solar customers. Furthermore, some solar proponents suggest ending the current NEM scheme will have minimal impact on payback and ROI for homeowners who pay cash or finance their system independently. On the other hand, other proponents of solar point to rapid job growth and record yearly installations as evidence of the continued success of NEM policy.

Ultimately, at the heart of this issue is the value of solar energy. As we have discussed before, this is an extremely challenging estimate to derive due to shifting generation mix and temporal variations. Seemingly acknowledging the dynamic nature of the value of solar energy, the CGS and CSS programs will be guaranteed for 2 years, after which the PUC will reevaluate market conditions and PV growth. In doing so, policy will continue to evolve in a way that achieves the goal of increasing solar capacity while ensuring adequate rate recovery to maintain grid infrastructure.