Act Now!

Maine doesn't offer many state specific solar incentives, but business owners can still take advantage of federal incentives. The 50% rebate on your solar energy system is one of the best incentives offered in the history of the solar industry, and it can be combined with some of the federal incentives listed below, so take advantage of the USDA's REAP Grant while it is still available. Fill out our interest form to get started!

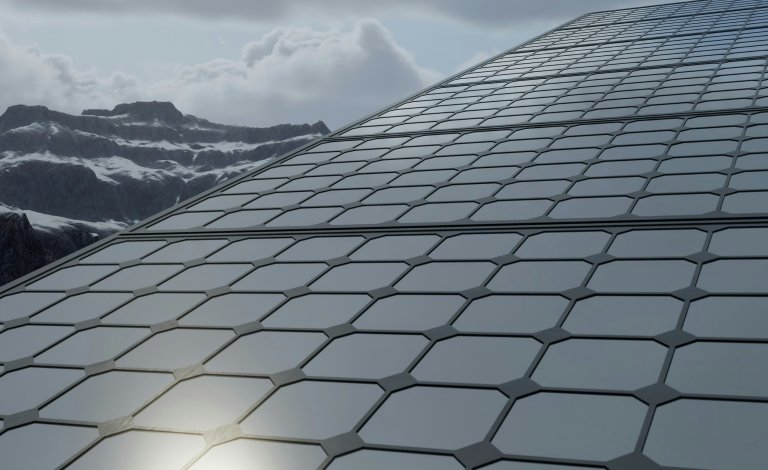

Solar Incentives in Maine

Maine business owners can take advantage of the Federal Investment Tax Credit to reduce the total cost of a solar energy system by 30%. This can be used in addition to the USDA's REAP Grant.

Business owners in Maine can take advantage of the federal Production Tax Credit (PTC). Solar systems under 1 MW that meet labor requirements are eligible for a tax credit of 2.75 cents per kWh. Larger solar systems over 1 MW that do not meet these standards still qualify for a lower rate of 0.55 cents per kWh.

Additionally business owners in Maine can qualify for the Domestic Content Bonus, which provides a 10% extra tax credit for projects using U.S.-manufactured materials, and the Energy Community Bonus, offering an additional 10% credit for projects in areas such as former coal communities. These federal solar incentives are available for up to 10 years after installation.

The REAP Grant is available in:

|

|

|

|

|

Ready to add solar to your business?

Let us connect you with the right installation team.