In a grid-tied Solar PV System unused energy can be sent back to the utility at the grid connection. Solar PV system owners receive utility credits for all the energy that is sent back to the utility. This unused energy is monitored at the utility meter, which essentially runs backward when collecting excess energy.

Through this process, utility companies are able to track energy surplus, resell it, and in some cases establish lower local rates if the energy surplus grows over demand.

In 2005, the state of New Jersey was the first to establish something called RECs (Renewable Energy Credits) also known as SRECs (Solar Renewable Energy Certificates) or TRECs (Tradable Renewable Energy Credits). At that time, the Department of Energy approved a process that shifts renewable energy surplus from subsidy programs to a market-based program thereby allowing SRECs to be bought and sold as commodities in the open market.

Through this process, renewable energy credits become certificates. The value of RECS are calculated by a basic formula of one Renewable Energy Certificate for every 1,000 kWh or 1 MWh of electricity it produces. Each REC is issued a unique identification number for accurate tracking. The Center for Resource Solutions is one organization that strives to develop minimum standards requirements for tradable renewable energy certificates (TRC) in addition to implementing a framework for tracking certificates issued in North America.

What is an SREC Auction for renewable energy?

There are two main markets for renewable energy certificates:

1. Compliance Markets: Markets created by states that require electric companies to supply a certain percentage of electricity from renewable energy generators by a designated time (i.e. 33% by 2020 or 24% by 2013).

2. Voluntary Markets: Markets created by customers that choose to buy renewable power out of a desire to “Go Green” (i.e. residential and commercial consumers).

Renewable energy generators located in states that do not have a Renewable Portfolio Standard can sell their RECS to voluntary buyers.

SREC Marketers

There are many qualifying renewable energy sources for REC trading, SRECs for solar electricity are among the most stable and widely approved renewable energy source.

SRECs may be traded directly from seller to buyer or through a third party REC Marketer, which is a broker or asset manager that will negotiate the sale on the sellers or buyers behalf for commission.

Likewise, renewable energy generating facilities may sell their credits to a marketer who in turn will resell the credits at a later date usually absorbing some risk due to market value fluctuation.

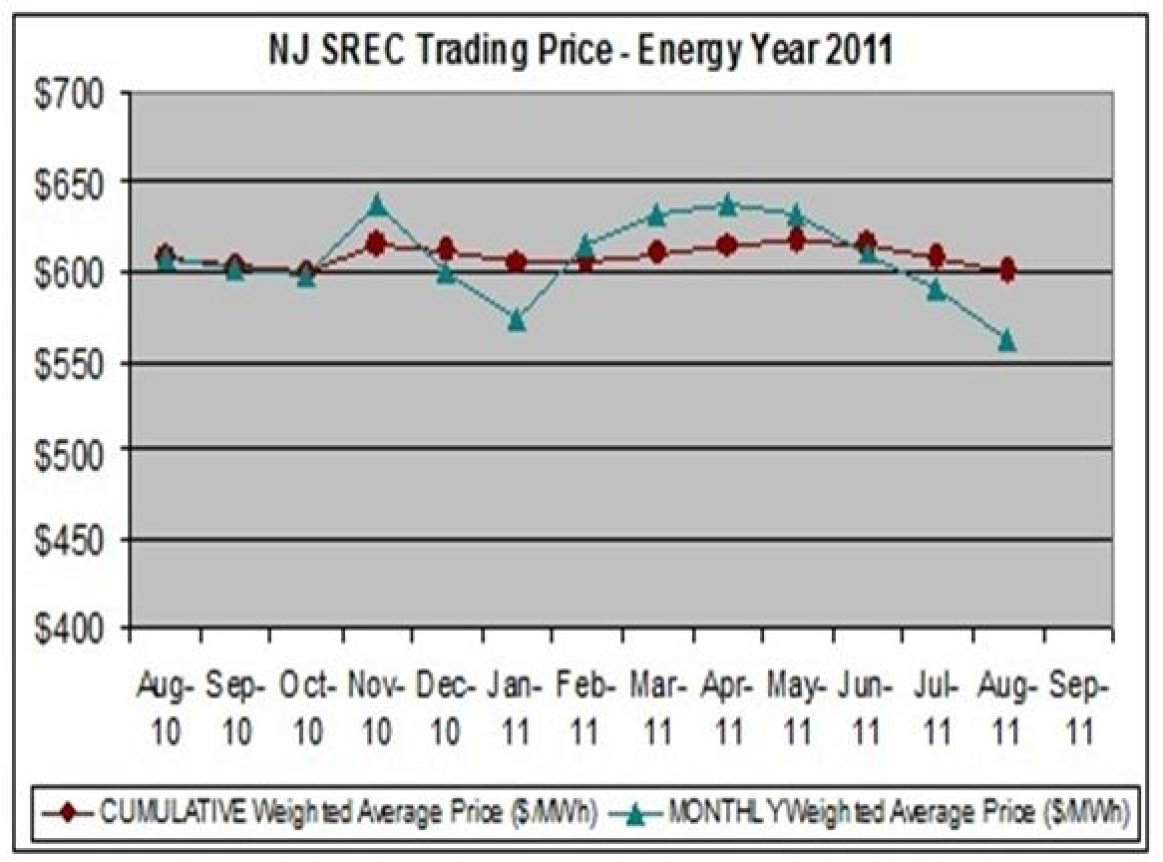

SREC Trading

REC Trading prices depend on many factors: A) the vintage year the RECS were generated, B) location of the facility, whether there is a tight supply/demand situation, C) if RECS were used for RPS compliance, and/or D) the type of power created.

SRECs tend to be more valuable in the 16 states that have set aside a portion of the RPS specifically for solar energy.

The primary reason for this is to promote diversity in the renewable energy resource market. Prices vary by state and are influenced by surplus as well as demand. The hope is that the income provided by SRECs and a long-term stabilized market for green tags can generate the additional incentive needed to build renewable energy plants in the future.

SREC Auctions

SREC Trade Auctions can occur as frequently as twice a month and incorporate buyers and sellers from one or more applicable states of:

1. Delaware

2. Maryland

3. Massachusetts

4. New Jersey

5. Ohio

6. Pennsylvania

7. Washington DC

Before an SREC Auction bids are collected from buyers and sellers then matched against each other. The point or price at which the buyer and seller bids match is the clearing price or fair market price. This price becomes the rate at which SRECS are bought and sold for that auction.

This method enables greater stability in the trading market wherein most buyers end up paying less than their offered price and most sellers get more than their asking price.

Resources:

Comments

This is great information. One thing I'm confused about: Does the accumulation of SRECs include all renewable power produced by a system, or just the power fed back into the grid (exported). I have heard that the credits represented all renewable power produced at a qualifying site. Thanks!

Thanks for this piece. What does it mean to retire a SREC? How do companies do that?

Thanks Greentech Renewables. This is a great post and thank you for the links to SRECTrade! If anyone has any additional questions about the ins and outs of SRECs, please feel free to check out srectrade.com for more information.

Thanks for the information. According to the Strategic Directions in the U.S. Electric Utility Sector Report, the power utilities industry is going through fundamental basic changes. The sixth-annual report was published Monday by Black and Veatch, a consultation and construction firm.